ICHRA Administrator Comparison

Why Businesses Choose Salusion

Simple, Low-Cost Pricing

No setup fees. No platform fees. No minimums. Pay only for employees who use it. The lowest-cost HRA on the market—simple, transparent, affordable.

Easy to Set Up. Easier to Administer

Set up your HRA in 15 minutes. From compliance to expense tracking to reimbursements, everything runs automatically. Salusion is the only small-business HRA with ACH reimbursements built in—so you spend almost no time managing it.

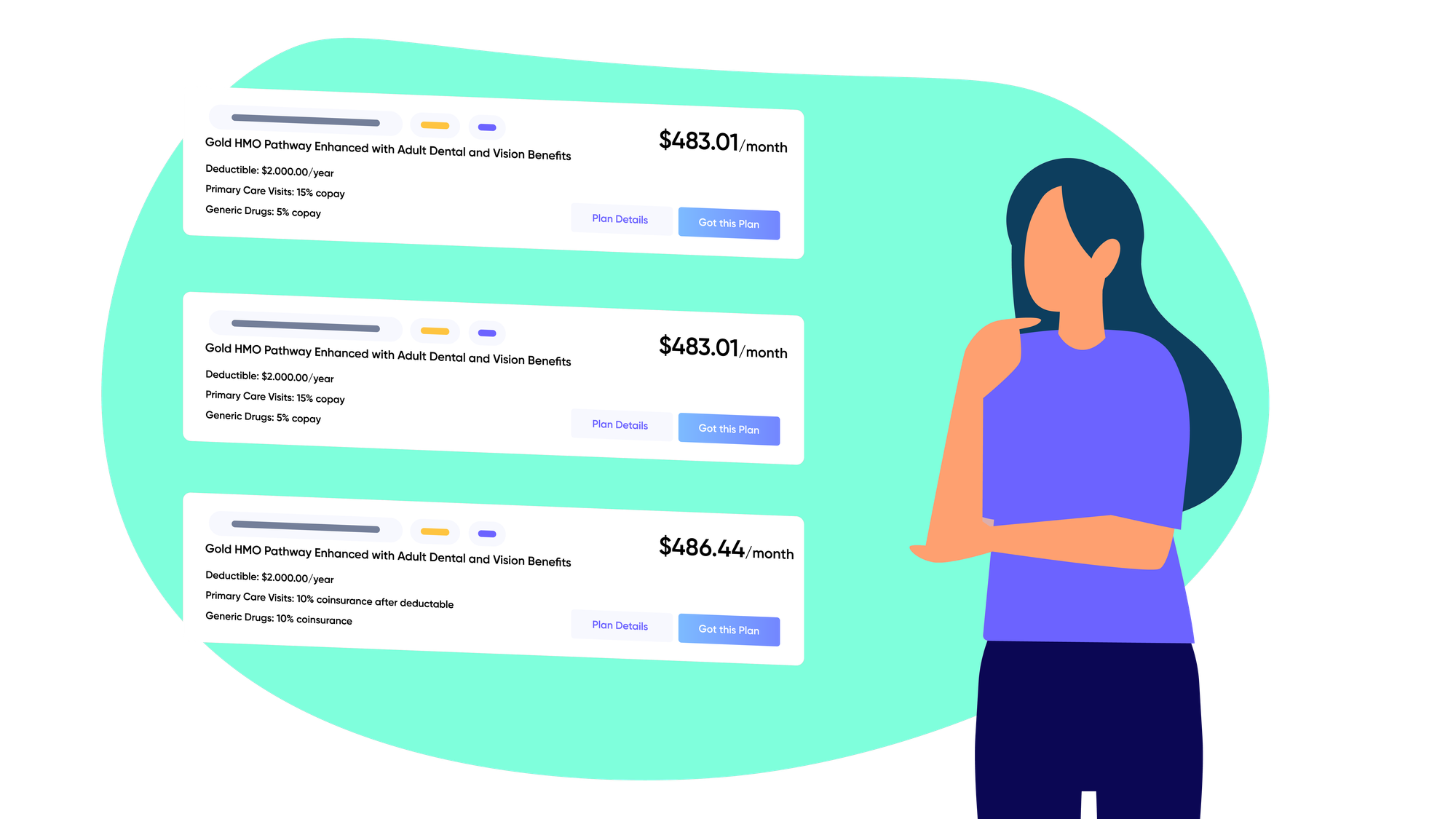

Built-In Employee Insurance Enrollment

Employees can compare plans and purchase individual health coverage directly through Salusion.

Real People. Expert Support

Most emails are answered in under an hour. Same-day Zooms with an expert give employers and employees confidence their issue will be solved quickly and completely.

Frequently Asked Questions

How do ICHRAs work?

An ICHRA runs on a 12-month plan year. Employers set a monthly allowance that can vary by employee class and may scale by age and family size. Employees are reimbursed for eligible expenses up to their balance.

Read the full guide →Who qualifies for an ICHRA?

Employees in an employer-defined class are eligible and must receive the benefit on the same terms and conditions, with limited variations allowed based on age or family size. Tax-free reimbursement requires individual health insurance or Medicare that meets MEC.

Read the full guide →What expenses can an ICHRA reimburse?

An ICHRA can reimburse individual health insurance premiums and other IRS Section 213(d) qualified medical expenses, as long as the employee has qualifying individual coverage or Medicare.

Read the full guide →